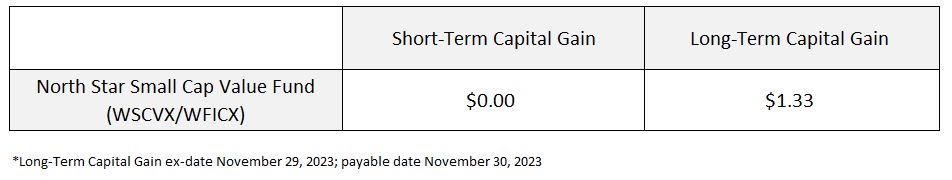

North Star has announced short-term and long-term capital gain distributions for 2023 on our North Star Small Cap Value Fund.

Investment Objective: The North Star Small Cap Value Fund seeks long-term capital appreciation.

Definitions

Short-Term Capital Gain

A profit on the sale of a security or mutual fund share that has been held for one year or less. A short-term capital gain is taxed as ordinary income.

Long-Term Capital Gain

The profit one realizes by selling a position one has held for longer than one year. For example, if one buys a stock or bond and sells it five years later for more than what one paid, this is considered a long-term capital gain.

Important Risk Information:

Mutual funds have investment risks including loss of principal. There is no guarantee either fund will meet its objective. In general, the price of a fixed income security falls when interest rates rise. There is a risk that issuers and counterparties will not make payments on securities and other investments held by the Fund, resulting in losses to the Fund. The Fund may invest in high yield securities, also known as “junk bonds”. High yield securities provide greater income and opportunity for gain but entail greater risk of loss of principal. Foreign common stocks and currency strategies will subject the Fund to currency trading risks that include market risk, credit risk and country risk. Municipal securities are subject to credit risk where a municipal security might not make interest and principal payments as they come due. The Advisor follows an investing style that favors value investments. At times when the value investing style is out of favor, the Fund may underperform other funds that use different investing styles. Investments in lesser known, small and medium capitalization companies may be more vulnerable than larger, more established organizations. As with any investment, there are risks associated with REITs. Investments in lesser-known, small and medium capitalization companies may be more vulnerable than larger, more established organizations. The Advisor does not attempt to keep the portfolio structure or fund performance consistent with any market index. Increased portfolio turnover may result in higher brokerage commissions, and other transaction costs may result in taxable capital gains.

Investors should carefully consider the investment objectives, risks, charges and expenses of the North Star Funds. This and other important information about each of the Funds are contained in the prospectus, which can be obtained at www.nsinvestfunds.com or by calling (855) 580-0900. The prospectus should be read carefully before investing. The North Star Funds are distributed by Northern Lights Distributors, LLC member FINRA/SIPC. 5905-NLD-11/28/2023